Forex traders often use a short-term MA crossover of a long-term MA as the basis 3 moving average crossover strategy for a trading strategy. An alternate strategy can be used to provide low-risk trade entries with high-profit potential. There are various forex trading strategies that can be created using the MACD indicator. In a downtrend, short sell when the MACD crosses below the signal line. You can see the financial news networks making a lot of hype when one of these combinations of moving averages tend to make a golden or a death cross. On the daily time frame for example, the 200-day, 80-day and 100-day moving averages are commonly used. This gives us the advantage of being able to capture more profits compared to waiting for the two moving averages to signal the buy and sell conditions for us. By doing so, we are essentially entering the trade a bit early. You avoid the day to day market noise as well which makes it easier for you to adjust your stops accordingly. This is one of the reasons why we choose the daily chart time frame. This is easy strategy, but you need to practice this on your demo account before applying this on your live account.Moving averages are a frequently used technical indicatorin forex trading, especially over 10, 50, 100, and 200 day periods.

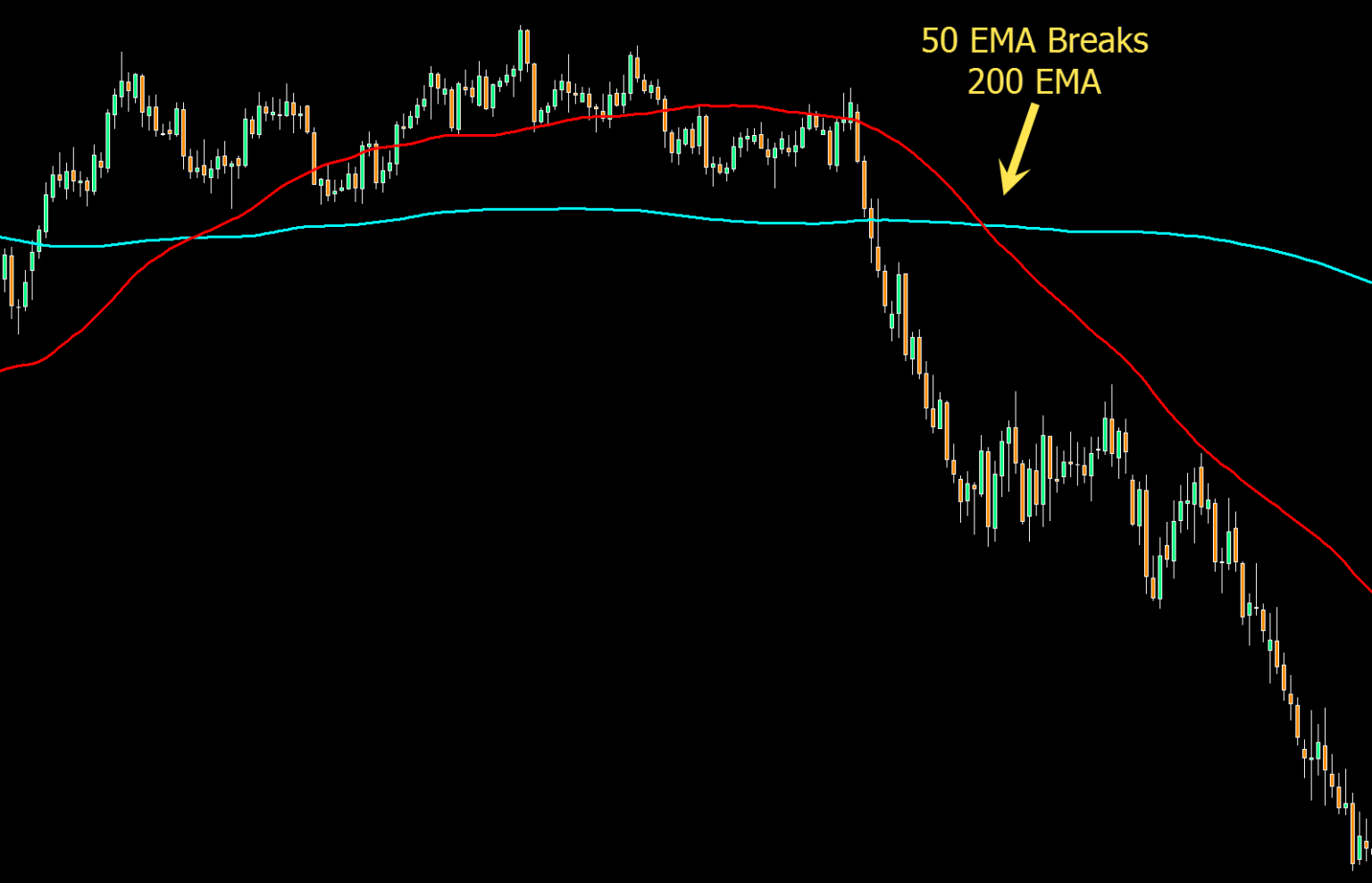

You must follow money management theory for following this EMA crossover strategy. You need to keep patience for more profit from this trendy trading strategy. So you should not apply this strategy on ranging market area. Risk warning: This EMA crossover strategy is suitable for trendy market. Similarly you can set stop loss above 200 EMA for sell entry. You can put stop loss below 200 EMA for buy entry. You should give stop loss below or above recent support or resistance. If you can catch a solid trend, then you can gain 800-1000 pips in cross pairs like as above image. You should close half position when you get 100 pips, then you need to move stop loss at entry point. If you can use on h4 and daily, you can set 100-200 pips take profit. Take profit and Stop loss: For scalping take profit will be 30-40 pips. You can use on shorter time frame for scalping But it is better to wait for little retracement and when price touches 15 EMA like as below image, then you will get sell signal. After crossover, you can take sell entry. When 15 EMA crosses 200 EMA from upper to below in the down direction, then you have to look for sell entry.

200 ema trading strategy how to#

How to get Sell signal For sell signal, you need to wait for crossover in the down direction.

When price takes little retrace and touch 15 EMA like as below image, then you will get buy signal. After crossover if price moves rapidly, then you need to wait for some retracement. When 15 EMA crosses 200 EMA from below to upper, then you need to look for buy entry. Required indicators: (1) 200 EMA (2) 15 EMA How to get buy signal First you need to wait for crossover in the up direction. If you get a solid trend in h4 or daily time frame, then you can gain 500-1000 pips from one trade only. As this is a trendy strategy, so success rate of this strategy is excellent. So you can get signals according to the trend. 200 EMA is very important technical tool to identify market trend. This crossover strategy is based on 200 and 15 EMA. Double EMA (Exponential Moving Average) crossover strategy is easy and profitable.

0 kommentar(er)

0 kommentar(er)